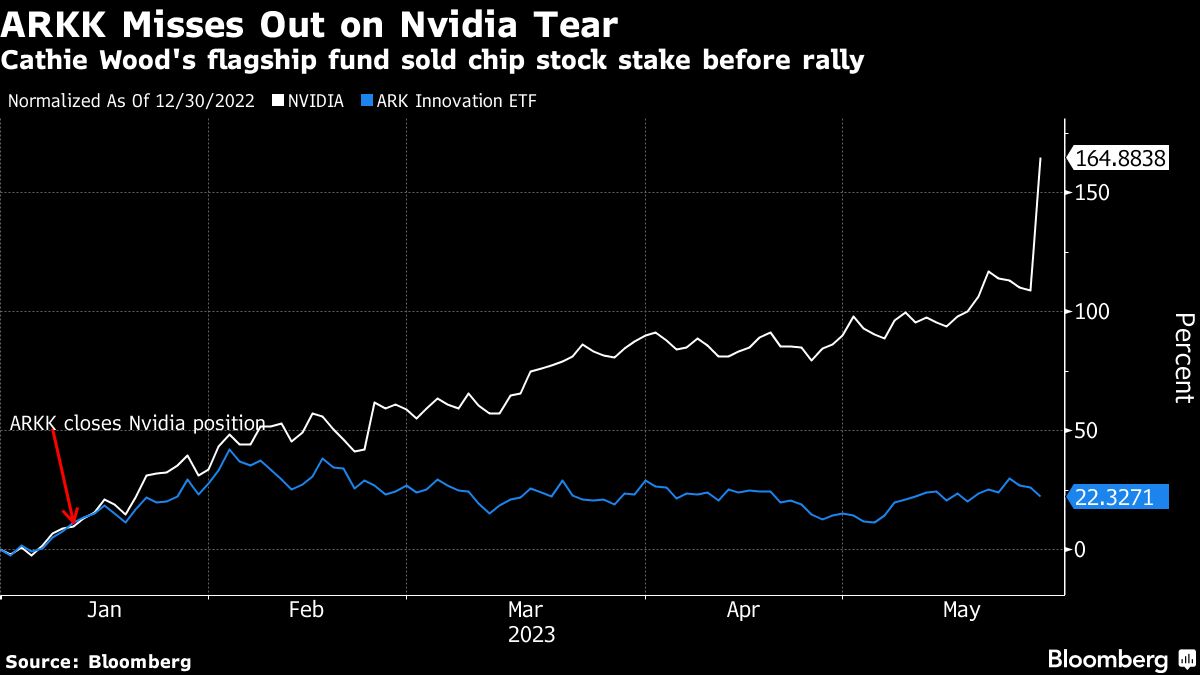

Cathie Wood’s flagship exchange-traded fund closed out its Nvidia Corp. stake in early January. Then, came the artificial intelligence frenzy that sent the stock and its big tech peers on a tear.

The chipmaker has added around $560 billion in market capitalization since Wood dumped her shares — with the last $200 billion of that surge coming overnight after the company handily beat earnings.

Although Wood holds Nvidia across several of her smaller funds, investors in the flagship ARK Innovation ETF (ticker ARKK) have mostly been left out of this year’s blistering 159.90% rally.

In February, when Nvidia traded for $234 a share, roughly 50 times forward earnings, Wood said the valuation was “very high.”

“We like Nvidia, we think it’s going to be a good stock. It’s priced —it’s the ‘check-the-box’ AI company,” Wood told CNBC on Feb 27. “For a flagship fund, where we’ve consolidated towards our highest conviction names, part of that has to do with valuation.”

A spokesperson for ARK Investment Management said the company doesn’t comment on trading activity.

Wavering Conviction

Wood has been a long-time fan of Nvidia, but her conviction on the stock has wavered at times.

When ARKK first launched in 2014, the chipmaker was one of the fund’s top holdings. And since the fund’s inception, Nvidia has contributed 13% of the fund’s 112% total return, according to data compiled by Bloomberg.

Only Tesla Inc., the Grayscale Bitcoin Trust, and Invitae Corp. have contributed more to the ETF’s total return since inception.

“I’m sure Cathie would have loved to have had Nvidia on this recent pop, but Nvidia has been very good to her. She was into the stock before it was cool,” said Eric Balchunas, senior ETF analyst at Bloomberg Intelligence.

May 26, 2023 at 10:16 AM

May 26, 2023 at 10:16 AM

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.