A new exchange-traded fund is making the case that having women at the top of corporations translates into better returns.

The Hypatia Women CEO ETF (ticker WCEO) exclusively invests in companies with a female chief executive officer. So far, that strategy is paying off.

Since the fund was introduced nearly two months ago, its 4.8% surge has bested the S&P 500 Index’s 2.4% climb in the same period.

“Before January 2023, there was no fund that would allow an investor to gender balance their portfolio from a leadership perspective,” said Patricia Lizarraga, CEO of Hypatia Capital and portfolio manager for WCEO. “We hope that by shining a spotlight on the performance of American public companies with women CEOs, we can increase the percentage of woman CEOs in the United States in all asset classes.”

The outperformance comes at a time when many women are ditching the workforce in response to burnout, a lack of advancement opportunities and inadequate support in juggling personal and professional duties.

Despite these challenges, women gained 34 seats on the boards of S&P 500 companies in the first two months of the year for the strongest annual start since at least 2019.

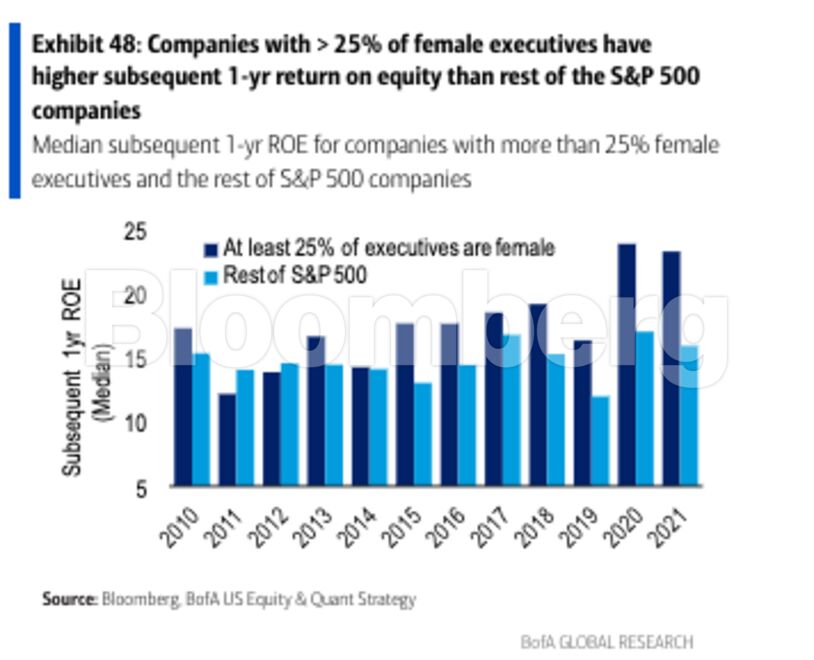

Return on equity for the following year has been higher for companies with over 25% female executives — compared to the rest of the S&P 500 — in nine of the past 10 years as of 2021, according to Bank of America.

Existing ETFs with similar mandates to advance gender equity have had mixed results as many don’t go as far as WCEO in seeking out firms with women at the highest organizational levels.

March 08, 2023 at 04:56 PM

March 08, 2023 at 04:56 PM

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.