What You Need to Know

- The funds are the latest brainchild of the manager behind the anti-ARK product, the $551 million AXS Short Innovation Daily ETF (SARK), which achieved rapid notoriety by creating an easy way to wager against Cathie Wood’s flagship strategy.

- Cramer recently made waves when he issued an apology for recommending Meta Platforms Inc.’s stock after it plunged, saying he was wrong to trust the firm’s management.

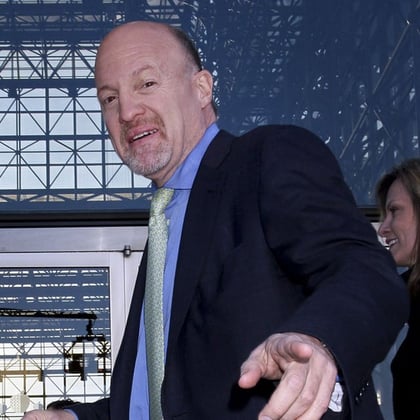

Whether you’re a lover or loather of Jim Cramer — and on both Wall Street and Main Street, there are plenty of each — you’re now able to express that view via the magic of ETFs.

A pair of new products is launching Thursday that will help U.S. investors bet either on or against the stock picks of the host of CNBC’s Mad Money show, arguably the world’s most-famous financial pundit.

The Inverse Cramer Tracker ETF (ticker SJIM) seeks to deliver returns that correspond to “the inverse of securities mentioned by Cramer” by either short-selling his equity picks or buying companies he recommends against, according to its prospectus.

Meanwhile, the Long Cramer Tracker ETF (LJIM) will back shares the CNBC anchor likes and ditch the ones he doesn’t.

Funds’ Creator

The funds are the latest brainchild of the manager behind the anti-ARK product, the $551 million AXS Short Innovation Daily ETF (SARK), which achieved rapid notoriety by creating an easy way to wager against Cathie Wood’s flagship strategy.

Now Matthew Tuttle, CEO of Tuttle Capital Management, has turned his attention to Cramer, fulfilling a long-running finance joke that the CNBC anchor should get his own inverse fund.

“If he specifically says either buy, buy, buy a stock, then we’re gonna go short that stock at the next practical moment,” Tuttle told Bloomberg’s Trillions podcast, referring to the inverse strategy. “If he tells you he hates a stock or sell, sell, sell or something like that, then we’re gonna go long that name again at the next kind of practical entry point.”

The merits of tracking a TV show for specific investment trades are unclear, and Cramer doesn’t claim to be advocating a long-term portfolio in his appearances.

Meanwhile, the methodology behind the ETFs is decidedly low-tech. To design the portfolios, which are equal weight, Tuttle and two colleagues watch Cramer’s television appearances throughout the day and monitor his Twitter account.

The result is two actively managed portfolios that hold between 20 to 50 names with a high turnover rate, Tuttle said. Both products carry an expense ratio of 1.2%.

Cramer’s Waves

Cramer is one of the most-famous names on Wall Street and an industry veteran. He’s a polarizing figure thanks to his brash, outspoken style and mixed history of recommendations.

March 02, 2023 at 12:40 PM

March 02, 2023 at 12:40 PM

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.