What You Need to Know

- The investor discusses his record of anticipating bubbles.

- He expects a recession next year and an accompanying stock market decline.

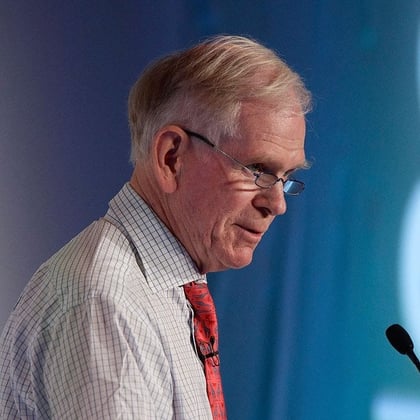

While many on Wall Street have stopped obsessing about a recession, Jeremy Grantham has not. That should shock no one who has followed the career of Grantham Mayo Van Otterloo & Co.’s co-founder.

Doubling down on the gloom in an interview taped for an upcoming episode of “Bloomberg Wealth with David Rubenstein,” Grantham said the Federal Reserve’s most aggressive tightening in four decades could tip the economy into recession and take the stock market with it.

“In the end, life is simple. Low rates push up asset prices. Higher rates push asset prices down,” he told Rubenstein. “We’re now in an era that will average higher rates than we had for the last 10 years.”

Grantham, 84, is well known for bearish forecasts that have occasionally been issued before big market shocks, such as in 2000 and 2008.

He called the post-pandemic surge in equities “in many ways about equal to the 2000 tech bubble” but said its deflation has been delayed by the frenzy surrounding artificial intelligence. His own call is on the line.

While prognostications of doom looked well-timed when shares tanked in 2022, they look less prescient amid this year’s rally.

During the wide-ranging interview, the renowned investor also discussed his record of predicting bubbles, what worries him the most about the economy and where he invests his money.

Do you think we’re in a major bubble right now in the United States? And do you think that the tech bubble has burst sufficiently?

I think we are descending from the 2021 bubble, which was one of the great bubbles. And this should be normally the deflationary period. Will the earnings decline, will profit margins decline, will the economy go into recession? Every great bubble has been followed by a recession.

Personally, I think AI is very important. But I think it’s perhaps too little too late to save us from a recession.

The deflationary forces from the tech stocks breaking in 2021, probably too big, the power of interest rates rising and depressing the real estate market, very negative, slow-moving influence, I suspect that they will once again dominate.

And we will have a recession running perhaps deep into next year and an accompanying decline in stock prices.

The recession that you’re predicting probably is not going to happen in 2023?

It may start in 2023.

The Federal Reserve recently said that they think we’ve cleared the recession hurdle and they don’t really project a recession any longer. Do you agree or disagree with that?

The Fed’s record on these things is wonderful. It’s almost guaranteed to be wrong. They have never called a recession, and particularly not the ones following the great bubbles.

They prided themselves in stimulating the bubbles. They took credit for the beneficial effect of higher asset prices on the economy. They have never claimed credit for the deflationary effect of asset prices breaking. And they always do.

You said not too long ago that you weren’t a big fan of Jerome Powell and the way he’s been handling inflation. Is that correct?

Yes, that’s correct.

And you think he’s done a better job recently in getting inflation under control?

It’s largely out of his hands. The forces work. I suspect inflation will never be as low as it averaged for the last 10 years, that we have reentered a period of moderately higher inflation, and therefore moderately higher interest rates.

September 05, 2023 at 06:22 PM

September 05, 2023 at 06:22 PM

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.