What You Need to Know

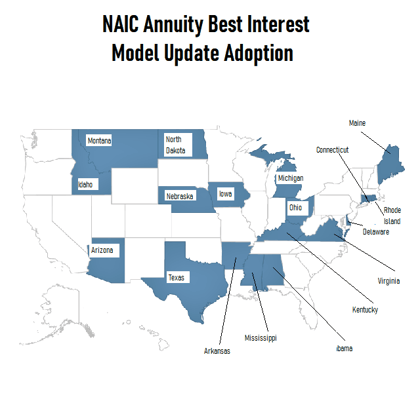

- Texas is the biggest state that has adopted the NAIC model update.

- California, Florida, New York and Pennsylvania have not.

- States may have to adopt the update to maintain their ability to regulate fixed annuities.

Kentucky and Mississippi have moved ahead with efforts to update their annuity sales rules without banning annuity sales commissions.

The states have adopted the National Association of Insurance Commissioners’ annuity sales standards model update.

Both states will now require insurers, agents and others to act in the best interest of the consumer when making recommendations about annuities, but the states will not require all annuity issuers, sellers and advisors to act as fiduciaries.

The states have become the 17th and 18th states to adopt the NAIC’s model.

The Kentucky update will take effect Jan. 1, 2022.

The Mississippi update will take effect Jan. 1, 2022, and apply to actions made on or after July 1, 2022.

Industry Group Reactions

The American Council of Life Insurers and the National Association of Insurance and Financial Advisors have been strong advocates of the adoption of the NAIC model.

The ACLI and NAIFA see adopting the NAIC model as a way to respond to critics’ complaints about high-pressure annuity sales practices without banning traditional annuity sales compensation arrangements. The ACLI and NAIFA contend that commission-based compensation is better than fee-based compensation for consumers who cannot afford to pay high fees.

ACLI President Susan Neely, NAIFA CEO Kevin Mayeux and Brian Wilson, the immediate past president of NAIFA Kentucky, put out a joint statement welcoming the new Kentucky sales standards regulation update and calling it “an important win for Bluegrass State consumers seeking lifetime income in retirement.”

Neely and George Pickett of the NAIFA government relations committee issued a similar joint statement in response to the Mississippi regulation update.

“Retirement savers seeking lifetime income from annuities should work with financial professionals who act in consumers’ best interest,” Neely and Pickett said. “The rule adopted by the Mississippi Insurance Department makes certain that they will.”

November 24, 2021 at 12:30 PM

November 24, 2021 at 12:30 PM

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.