What You Need to Know

- The Medicare annual enrollment period runs from Oct. 15 to Dec. 7 each year.

- This is the time when clients already on Medicare can make changes to their coverage.

- Clients should review changes in their existing plan as well as their health situation to determine if they need to select a new plan.

For clients already enrolled in Medicare, the annual open enrollment period during which they can change their Medicare options is right around the corner. The enrollment period runs from Oct. 15 to Dec. 7 each year.

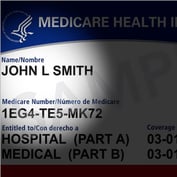

During the annual enrollment period, clients can change any aspect of their coverage, including drug plans and Medicare Advantage plans. This is different from the initial enrollment period, which generally spans a seven-month period — three months before and after the month your client reaches age 65, as well as the month of their birthday.

Whether they elect to make changes during the annual enrollment period or keep coverage as-is, clients’ choices will be effective as of Jan. 1 of the following year.

You want to be sure that your clients are looking at their coverage each year to help ensure that they have the best coverage for them at the lowest cost. If they need professional help in choosing another plan, and if you don’t do this type of work yourself, you should refer them to a trustworthy professional who does and who has the needed expertise.

In the coming weeks, advisors should set aside time to have a discussion with clients on Medicare to help them decide if any changes in their coverage may be needed. Here are a few topics to make sure to hit.

Alternative Coverage Options

The annual enrollment period is the time to work with your client to review their health needs against their current coverage. Things they can do during the annual enrollment period include:

- Switch from original Medicare, Parts A and B, to a Medicare Advantage plan (Part C). In order to do this, they must have first been enrolled in Parts A and B.

- Switch from one Medicare Advantage plan to another.

- Drop their Medicare Advantage plan and go back to original Medicare Parts A and B.

- Switch from a Medicare Advantage plan that does not offer a drug plan to one that does, and vice versa.

- Join a new Medicare drug plan.

- Switch from one Medicare drug plan to another.

- Drop Medicare drug coverage completely.

- Add a Medigap supplement.

Deciding whether to take any of these actions should be based on planning for your client’s evolving medical needs.

Changes to Medicare Plan Costs

It is common for Medicare Advantage (Part C) and Medicare drug plans (Part D) to raise prices going into the new year. You will want to review any changes in premiums, deductibles and other cost issues with your client each year prior to the annual enrollment period.

Plans typically provide an Annual Notice of Change letter each year by September. Encourage your client to review this. You should consider looking at it as well to be in a position to answer any questions they may have, or to provide guidance in getting answers from the plan provider.

If these cost increases or any changes in plan coverage are problematic for your client, it may make sense for them to look at other Medicare options.

Changes to Plan Coverage

Medicare Advantage plans and Medicare prescription drug plans can change over time. A hospital may drop out of the plan’s network. A drug your client needs may not be part of the prescription drug plan’s formulary going forward even though it had been in the past.

September 19, 2022 at 04:51 PM

September 19, 2022 at 04:51 PM

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.