A company that provides a home for life insurers’ unwanted variable annuities has picked Russell Investments and Franklin Templeton to help it run the investment funds inside the contracts.

Venerable Holdings announced that Russell will be the sub-advisor for six of the funds in the new Venerable Variable Insurance Trust business, and Franklin Templeton will be the sub-advisor for three funds.

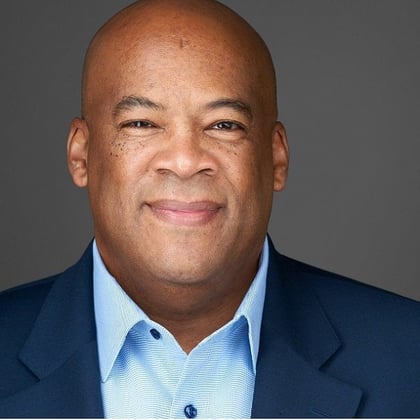

Tim Brown, president of Venerable Advisers, Venerable’s new RIA unit, said Venerable likes Franklin Templeton’s investment management expertise and Russell’s funds.

“It was important to select partners with the right capabilities and expertise,” Brown said.

What it means: Venerable’s RIA could eventually manage a substantial amount of variable annuity assets for clients with old annuities.

Venerable has assumed responsibility for tens of billions of dollars of annuities from issuers like Voya, Equitable and John Hancock. The latest financial statement for the firm’s Venerable Insurance and Annuity Co. subsidiary shows that the company ended the second quarter with about $19 billion in assets in separate accounts and related types of accounts.

The players: Venerable is a West Chester, Pennsylvania-based company that was started in 2018 by a group of companies that included Apollo Global Management, Athene and Reverence Capital Partners.

Venerable Insurance and Annuity Co. administers about 200,000 in-force annuity contracts.

October 17, 2023 at 01:34 PM

October 17, 2023 at 01:34 PM

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.