What You Need to Know

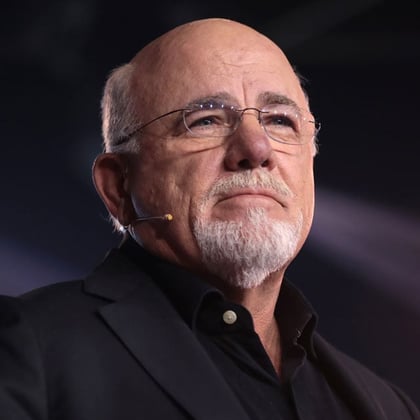

- Dave Ramsey sparked an uproar by arguing that retirees should invest and spend much more aggressively than researchers suggest.

- Some well-known financial planners criticized the national personality's argument for 8% withdrawals and a 100% stock allocation.

- Income experts hope that the ongoing debate will focus attention on the complex and evolving issues tied to retirement spending.

Dave Ramsey has done financial advisors a favor by bashing the conclusions of several retirement experts about “safe” withdrawal rates, two veteran financial planners say.

The uproar around the provocative planning personality’s controversial advice to withrdaw 8% of retirement assets a year has drawn attention to the need for tailored retirement spending approaches for clients as planners have jumped into the conversation.

During a recent podcast, Ramsey blasted retirement spending researchers, calling them “supernerds” and “goobers” who “live in their mother’s basement with a calculator.”

Ramsey went on to argue that the industry’s traditional 4% withdrawal rule (and more recent income planning strategies that utilize dynamic guardrails to control spending) is overly conservative and fails to fully leverage the power of the stock market.

Rather than depending on carefully calculated spending strategies that are revisited and adjusted over time, he suggests a 100% stock portfolio and 8% annual withdrawals.

The assertion may fly in the face of the typical fiduciary financial professional’s perspective, but it also provides financial advisors with an entry point for deeper planning conversations with their clients and prospects.

That is, advisors can demonstrate exactly what Ramsey fails to discuss about sequence of returns risk, the growing challenges of longevity and the dangers that are presented by relying on overly bullish market predictions.

This was the consensus of a number of financial planning experts who were asked to weigh in on the Ramsey vs. “Supernerds” debate, including Bryn Mawr Trust’s Jamie Hopkins and Morningstar’s John Rekenthaler.

While he understands his colleagues’ skepticism about Ramsey’s 8% spending argument, Hopkins tells ThinkAdvisor he is actually much less skeptical than others may be, and he cites his deep engagement with the latest planning research as the cause.

As Hopkins explains, the real reason there can be so much debate about retirement spending strategies is that there is “actually no single right answer on this topic, and the spending question is more of a true debate versus a question of what is right or wrong.”

Ramsey’s Views & Trio’s Response

Ramsey, for his part, argued that the safe spending figure is actually around 7% or 8%, a viewpoint based in large part on his simultaneous assertion that many retirees would be better off with a 100% stock allocation as opposed to a traditional 60-40 or even 50-50 mix of stocks and bonds.

Both the traditional 4% withdrawal rule and more recent spending guardrails frameworks use these “safer” asset allocations, and Ramsey further argued that such a “pessimistic” investing and spending approach could lead many people to believe that they can never afford to retire.

Taking to LinkedIn, the retirement researcher Wade Pfau suggested that Ramsey’s perspective may sound rational to the typical novice investor, but the reality is that he is speaking from the position of a total returns “extremist.”

“If that’s your thing, then more power to you,” Pfau wrote. “But he is suggesting a very risky approach to retirement income, and not all his listeners will understand the risks they are taking with an 8% withdrawal on a 100% stocks portfolio.”

Beyond his comments on social media, Pfau was one of a trio of self-professed supernerds who responded to Ramsey’s call-out in a widely circulated ThinkAdvisor commentary piece. In it, Pfau argues alongside Michael Finke and David Blanchett that Ramsey’s position dangerously overlooks that the sequence of returns risk is real — and it’s a big part of what makes retirement income different from pre-retirement wealth accumulation.

What Planners Are Saying

Among the dozens who responded to the “supernerds” kerfuffle on social media was Roger Whitney, a certified financial planner and founder of the Rock Retirement Club.

“I’ve met [the supernerds] and think they are intelligent, wonderful people,” Whitney wrote. “The debate is, what is a safe withdrawal rate? 8% over 4%? This is an academic question.”

As Whitney and many others emphasize, sound retirement planning isn’t based on any single metric, whether that is a safe withdrawal rate or any other figure.

“No one creates a plan and sticks to it throughout retirement,” Whitney argues. “Goals and markets are messy. Heck, life is always messy. The one constant I’ve seen in walking with retirees is CHANGE. Some are predictable, but most are not!”

Whitney adds that the “supernerds” are correct in advocating for flexibility and some measure of caution in the income planning process, given just how high the stakes are for any given individual or couple. Failure, in this planning context, can mean that aging Americans run out of money to fund their lifestyle at a very vulnerable time in life, when returning to work or reducing spending can be difficult or impossible.

“Changes in goals, circumstances, markets, interest rates, etc., all happen randomly,” Whitney warns. “Ultimately, it doesn’t matter whether a retiree starts with an 8% or 4% withdrawal rate. What matters most is having a sound process faithfully followed to make little adjustments as life unfolds. The uncomfortable truth is there is no answer.”

November 21, 2023 at 10:36 AM

November 21, 2023 at 10:36 AM

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.