What You Need to Know

- A non-fungible token is an asset that's hard to trade for another, seemingly similar asset.

- Life insurance policies are associated with insured characteristics that may reduce policy fungibility.

- One valuation obstacle is determining the provider's and the broker's share of the deal proceeds.

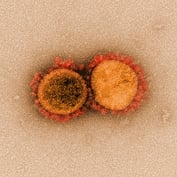

The founder of Twitter recently sold his first tweet using a digital tool known as a non-fungible token or NFT.

Using blockchain technology, he was able to sell a unique digital version of this first tweet at auction for $2.9 million. Pretty amazing. Any of us could take a screenshot of his tweet and duplicate it thousands of times, like any other digital image, but this technology has made it possible to create a unique digital version of something with an NFT.

The term fungible has always been fascinating to me, particularly as it relates to life insurance — which is also non-fungible in its own way. What’s interesting today is that while a life insurance policy is non-fungible, the life settlement industry seems to treat policies in a different way which ultimately hurts agents and their clients.

Not a Dozen Nails

Before you think I have gone off the blockchain deep end, let me explain. First, what’s a fungible item? Anything that is interchangeable with the same value is fungible. If you go to the hardware store to buy a dozen nails, you can reach into a bucket and pull out any 12 nails, and they are each worth the same amount of money. The nails are interchangeable and have the same value — fungible. Now consider a piece of art, like a painting or a sculpture. It’s unique and so is the value. You can’t make an even trade between a Monet and a Picasso — non-fungible.

I argue that life insurance is a non-fungible item. While many $1 million life insurance policies may be out there, there’s usually only one written on a particular individual with that person’s unique characteristics: age, height, weight, health, etc. Life insurance policy — non-fungible.

In some cases, non-fungible things are worth more but not always. However, I think a problem arises when non-fungible items are treated as if they were fungible. This happens in the life settlement industry.

The traditional process of determining a life insurance policy’s value is incredibly murky. In fact, the marketplace for life insurance policies is far from transparent. When a life insurance policy is sold as part of a life settlement, oftentimes the actual value is not known by the seller or their agent.

What a Policy Is Truly Worth

In a traditional life settlement scenario, after an agent and the client discuss a life settlement, the policy information will be sent to a broker who then shops the policy to different provider companies. That’s where the dark arts come into play. What happens between the provider and the broker is in most cases completely unknown to the agent and the policyholder. The broker will come back with an offer but never tell the policyholder how much the policy is truly worth. They are playing around with the value equation.

June 02, 2021 at 04:03 PM

June 02, 2021 at 04:03 PM

Stephen E. Terrell is president of

Stephen E. Terrell is president of  Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.