Chart from Cornerstone Research’s new report on trends in securities class action litigation settlements: “Securities Class Action Settlements–2018 Review and Analysis.” Photo: Cornerstone Research.

Chart from Cornerstone Research’s new report on trends in securities class action litigation settlements: “Securities Class Action Settlements–2018 Review and Analysis.” Photo: Cornerstone Research.

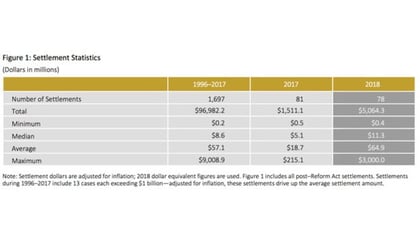

Corporations paid $5 billion to settle shareholder class actions last year, a sum more than triple that of 2017, and more of them are resolving for larger amounts, according to a report by Cornerstone Research.

The annual report found that there were 78 securities class action settlements in 2018, three fewer than in 2017, but five surpassed $100 million, including the $3 billion deal with Brazilian energy giant Petrobras. More significantly, the average settlement tripled to $64.9 million, when compared to 2017, exceeding the average over the past nine years and reflecting a trend toward larger settlements overall. In fact, the report found that 32 cases settled between $10 million and $49 million in 2018.

“These higher dollars aren’t just driven by a small number of very large cases,” said Laura Simmons, senior adviser of Cornerstone Research, which teamed up with Stanford Law School Securities Class Action Clearinghouse on the report. “In this case, we actually had an upward shift in the size of the typical case.”

Not only was the average higher, the median settlement value more than doubled from 2017 to $11.3 million, according to the report. Also, the number of settlements valued at less than $5 million declined by nearly 40 percent from 2017.

“It was the first year since 2010 in which more than half of the settlements exceeded $10 million,” Simmons said. “We really had a shift towards larger cases.”

The report also looked at the settlement values as a percentage of alleged shareholder damages, referred to as “simplified tiered damages.” In 2018, the median settlement as a percentage of “simplified tiered damages” increased to 6 percent, compared to a 5.1 percent median for the past nine years.

March 26, 2019 at 06:25 PM

March 26, 2019 at 06:25 PM

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.