What You Need to Know

- Economist Jeremy Siegel says that the market is strong, with lower inflation and good profits.

- He also says he sees no significant overvaluation in the stock market.

- In his column, Siegel says that he lowered his outlook on the chances of a recession.

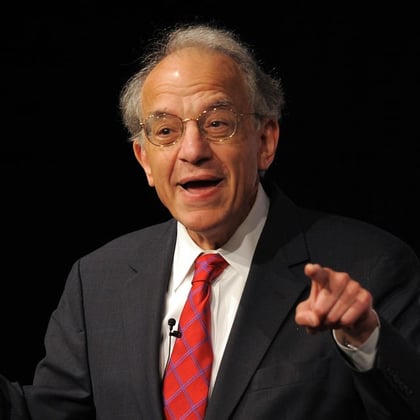

Economist Jeremy Siegel thinks the U.S. stock market is heading to new highs, given an improving economy and better corporate earnings outlooks.

“This is such a strong market,” the Wharton School professor emeritus of finance said Friday on CNBC’s “Closing Bell.”

Companies’ guidance was tentative in the first half, but now executives seem more confident as internal factors improve, Siegel, also a senior economist at WisdomTree, said. Among other positive signs, the Employment Cost Index came in below expectations, he said.

“Goldilocks — lower inflation and stronger economy and good guidance and good profits, what’s to stop this market now?” Siegel said.

He made similar comments on Monday in his weekly WisdomTree column: “For now, it looks like the markets are bound to make new highs.”

The economist said on CNBC that he’s unsure whether the Federal Reserve and Chairman Jerome Powell are done raising interest rates, “but what I’m pleased about is that he acknowledges that there are two-sided risks,” and that Fed officials enter meetings without preconceived notions on what they’ll do with rates.

“They’re going look at the data, which is something that I’ve urged for quite a while,” he added.

The U.S. Bureau of Economic Analysis last week estimated that GDP grew by 2.4% in the second quarter, after increasing by 2% in the first. No one thought the U.S. economy would grow faster than 2% in the first half, “so inflation coming down, stronger economy, I don’t see this stopping any time soon,” Siegel said.

July 31, 2023 at 02:28 PM

July 31, 2023 at 02:28 PM

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.