What You Need to Know

- Josh Barrickman now controls almost as much U.S. debt, including Treasuries, agency and corporate bonds, as China — America’s second-largest foreign creditor.

- He oversees three of the world’s four largest bond funds, including the $298 billion Vanguard Total Bond Market Index Fund, according to Bloomberg data.

- Last year, his $92 billion Vanguard Total Bond Market exchange-traded fund (ticker BND), lured $14 billion to become the world’s largest bond ETF.

When March’s bank failures ignited a historic bond rally, few, if any, made more money than Josh Barrickman. His army of funds gained roughly $26 billion, the equivalent of more than $1 billion in paper profits every single trading session.

Yet Barrickman didn’t predict Silicon Valley Bank’s collapse, or Credit Suisse’s tortured final days. He doesn’t even have a view (at least that he’s willing to share) on what the Federal Reserve will do next.

He runs Vanguard Group Inc.’s $1 trillion bond indexing business for the Americas, a class of investing that — to the outside world, at least — is as vanilla as it gets.

There’s nothing vanilla about the money he’s pulling in, though. The soft-spoken 47-year-old’s funds lured $31 billion last year, even as active managers posted unprecedented outflows amid the worst year for bonds since at least 1977.

In fact, he now controls nearly as much U.S. debt — including Treasuries, agency and corporate bonds — as China, America’s second-largest foreign creditor.

That makes Barrickman exhibit A of a passive management revolution that’s reshaping the world of fixed-income, just as it did equities a decade ago. No longer dominated by traders making multimillion-dollar bets and eating what they kill, the real money is flowing to guys like him, whose decisions are increasingly rippling through markets.

“We do have size and scale, and that matters in the marketplace,” Barrickman said in an interview. “Tracking is job one, two and three,” he said, adding “if we can have a basis point a year, that’s a lot of real money.”

Equity investors have been shifting to passive index products for years. Created decades ago, their popularity ballooned following the 2008 financial crisis, fueled in part by skepticism of active money managers after stocks cratered.

The transition has been slower in fixed-income. Indexes are made of tens of thousands of over-the-counter bonds, many of which are so illiquid they won’t change hands for weeks at a time.

It’s hard to buy the entire market the way equity investors can buy every stock, making it more difficult for an index fund to track the performance of its benchmark closely.

Indeed, the fixed-income market has long been seen as more complex relative to stocks, allowing firms to justify the need for active management, and the juicier fees that come with it.

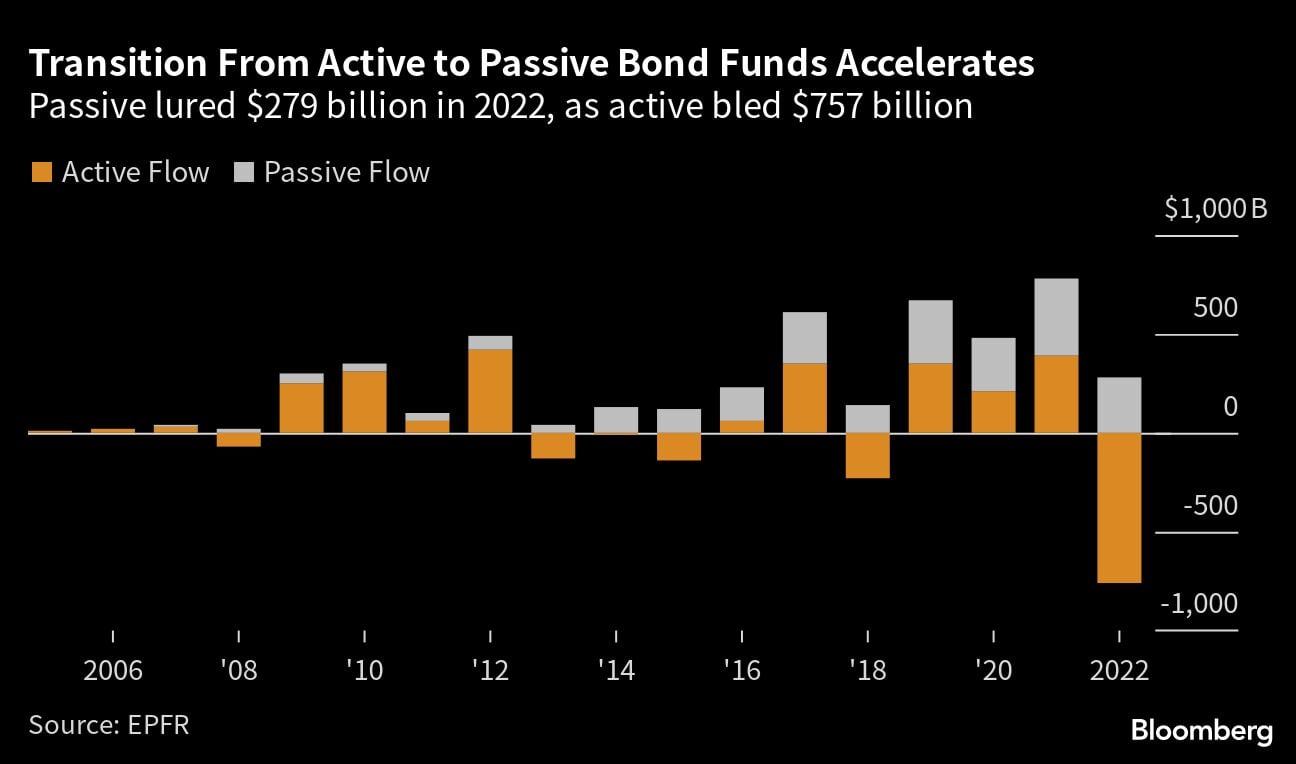

But history is repeating. The dramatic losses in debt markets last year, fueled by the most aggressive Federal Reserve policy tightening in a generation, has turned what was once a relatively slow and steady shift away from active bond funds and toward passive products into a stampede.

The gap between passive and active net flows reached a record $1.04 trillion in 2022, almost triple any other year, according to data from EPFR. Passive funds lured $279 billion in new cash, while active funds bled $757 billion.

As of March, assets managed by passive funds surpassed $3 trillion for the first time. They now account for 31% of the fixed-income fund universe, the data show, up from just 13% a decade ago.

Barrickman himself now oversees three of the world’s four largest bond funds, including the $298 billion Vanguard Total Bond Market Index Fund, according to data compiled by Bloomberg.

That means many of the decisions he makes, like which bonds to buy when trying to replicate his funds’ underlying benchmarks, can have big consequences for the market (the Vanguard Total International Bond Index Fund, for example, only holds roughly half the 13,000 bonds in the index it tracks.)

“We have to be, by definition, overweight some places and underweight others to build a sample,” Barrickman said. “We’re dealing in a market that forces us to take some active positions.”

May 09, 2023 at 04:07 PM

May 09, 2023 at 04:07 PM

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.