What You Need to Know

- The buyer of First Republic Bank has seen its stock soar 26% in 2023, outpacing its major competitors.

- The bank is four times larger than all three other bidders — PNC, Citizens and Fifth Third — combined.

- Even competitors acknowledge the success of JPMorgan CEO Jamie Dimon.

More than a decade after regulators vowed to tame the risks of too-big-to-fail banks, White House officials were on a call. Why, one attendee asked, was JPMorgan Chase & Co. allowed to buy First Republic Bank that morning in a government-led auction?

The answer came, flatly, from Treasury Secretary Janet Yellen: They had the highest bid.

After a year marred by the biggest U.S. bank failures since the 2008 financial crisis, the nation’s largest lender is on familiar footing — scooping up a weakened rival, reeling in its clients and minting record profits along the way.

Yet for most of the industry, 2023 was bleak.

In the first half, dozens of regional lenders swooned — and some collapsed — as rising interest rates slashed the value of assets on their books, saddling U.S. banks with $684 billion of unrealized losses.

Many firms have since spent heavily to keep depositors from leaving. Some started raising the possibility of defaults on commercial real estate loans. Bond-rating firms have downgraded banks in batches.

As all that trouble started spilling into view in March, nervous depositors showed up at JPMorgan with more than $50 billion.

The firm’s executives raised expectations for net interest income — the difference between what a bank earns on loans and what it pays out to savers — a whopping four times throughout the year, eventually pulling in so much that the managers have taken to warning that it’s “over-earning.”

That’s put JPMorgan on track for the biggest annual profit in the history of American banking.

Its earnings from the first nine months alone would rank as the company’s second-best year ever. Analysts predict that by the end of this month, its annual net income will be 36% higher than last year — while the combined earnings of the next five largest banks rises about 1%.

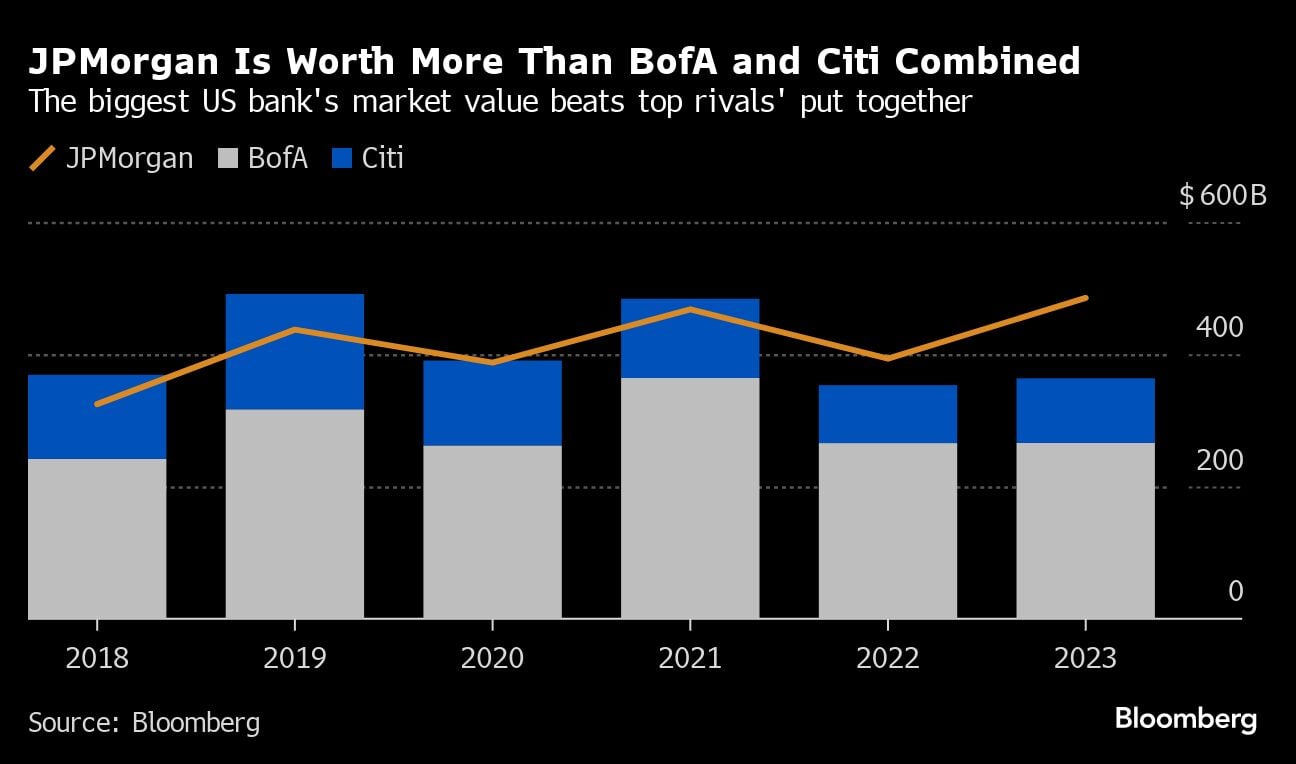

JPMorgan’s stock has soared to a record, gaining 26% in 2023 and outpacing every major competitor. The 24-member KBW Bank Index and 50-firm KBW Regional Banking Index are both down.

“There’s a certain level of frustration from other banks,” said Lee Raymond, the oil veteran who spent 33 years on JPMorgan’s board. “When things kind of get in tough shape, it’s an opportunity for somebody like JPMorgan to acquire some things that they would like to acquire but aren’t in a position to.”

Raymond would know: He helped create the country’s largest oil company just before steering JPMorgan through its own massive deals.

‘Real Issues’

When the Federal Deposit Insurance Corp. announced that JPMorgan won the auction for First Republic, it called the process “highly competitive” and noted that the bank, which Jamie Dimon has led for 18 years, offered the smallest hit to the agency’s main insurance fund. Still, some regulators were uneasy with the outcome.

“If they’re able to scoop up all of the failed institutions, even when there are other bidders, it raises real issues,” Consumer Financial Protection Bureau Director Rohit Chopra told the Senate Banking Committee.

A Treasury spokesperson declined to comment when asked about the White House call, which was described by people with knowledge of the conversation. “First Republic was resolved with the least cost to the Deposit Insurance Fund, and in a manner that protected all depositors,” the department said in a statement.

It’s no wonder that JPMorgan could write the biggest check. The bank is four times larger than all three other bidders — PNC Financial Services Group Inc., Citizens Financial Group Inc. and Fifth Third Bancorp — combined.

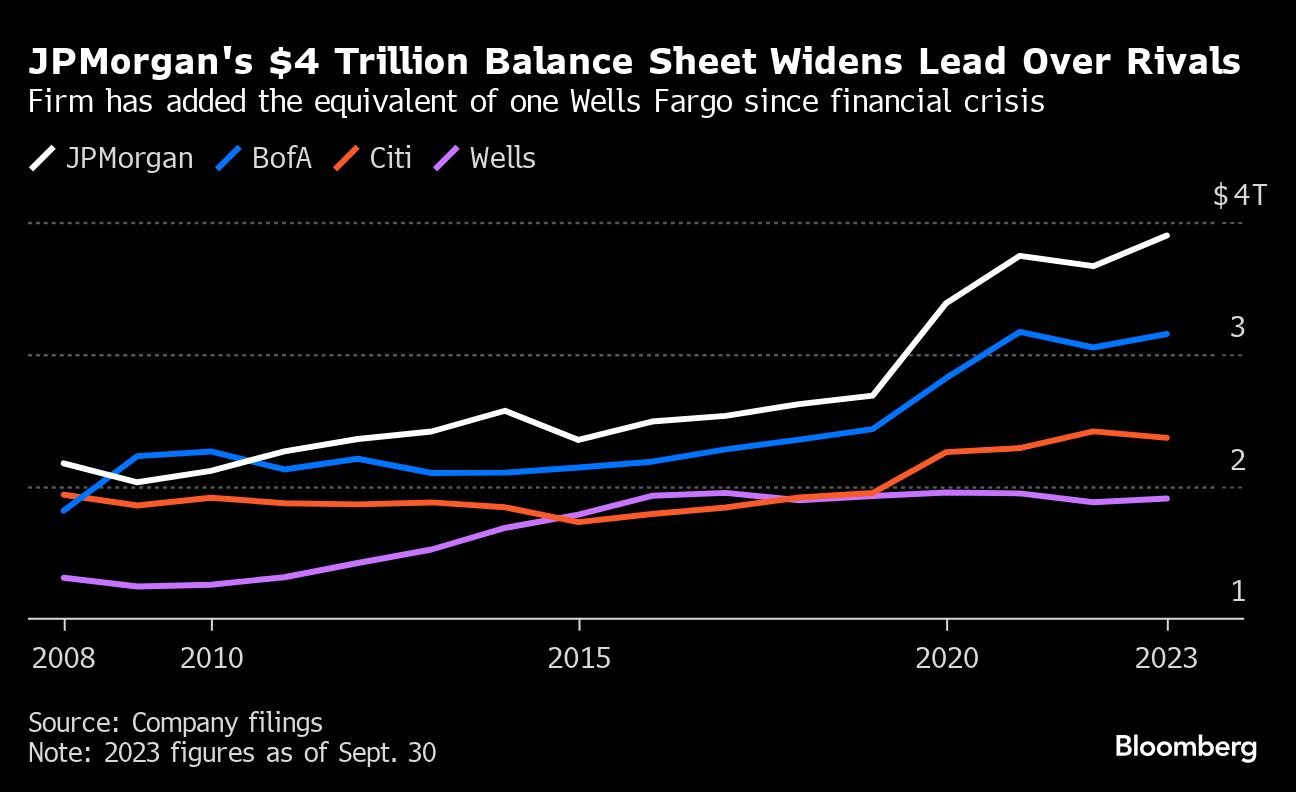

Put differently, since Dimon scooped up Bear Stearns and Washington Mutual during the 2008 financial crisis, JPMorgan has added a mountain of assets equal in size to Wells Fargo & Co., which is itself the fourth-largest U.S. bank.

Even Dimon’s competitors have acknowledged his success. Morgan Stanley Chief Executive Officer James Gorman recently praised him on television as the best bank executive in the world. Raymond, who left JPMorgan’s board in 2020, compared him to John D. Rockefeller, the Standard Oil baron.

“There is nobody in the banking business that I’ve seen that compares,” Raymond said. “It’s really hard to see where anybody has done what JPMorgan has been able to do.”

Peers Stumble

The idea that some banks are too big to fail was popularized during the 2008 crisis, when officials emphasized the necessity of bailing out lenders whose collapse would have tanked the global financial system. The phrase had the ring of a slur then, but enormity has turned into a marker of stability, attracting clients in times of uncertainty.

December 27, 2023 at 02:27 PM

December 27, 2023 at 02:27 PM

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.