What You Need to Know

- The S&P 500 fell for the first time in 10 weeks, snapping the longest streak of gains in almost 20 years.

- In the stock market, the pullback followed a flurry of buying that had sat uneasily with Wall Street contrarians.

- Viewed through the lens of positioning, the picture arguably remains bearish.

This isn’t how Wall Street hoped to ring in 2024.

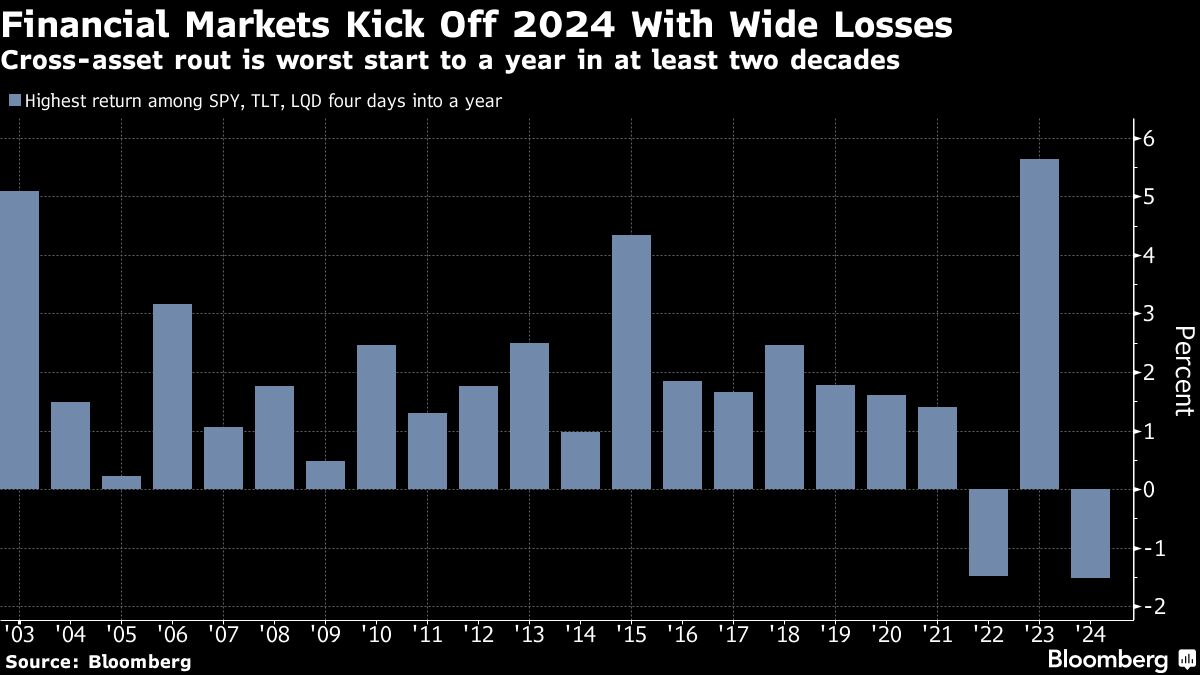

Loaded up and bullish after a spirited holiday rally, investors were smacked with old worries in the new year, among them fresh questions about the path of Federal Reserve policy. The result: a cross-asset drubbing that surpassed any to start a year in at least two decades.

The S&P 500 fell for the first time in 10 weeks, snapping the longest streak of gains in almost 20 years. Treasuries and corporate credit dropped the most since October.

For traders primed for interest-rate cuts in March, a hotter-than-forecast jobs report potentially blurred the outlook further on Friday. But the seeds of disillusionment were sown weeks before, when investors shed bearish wagers and dived into risky assets of all stripes.

With the pool of new buyers running low, bulls were left to contend with a nagging sense they’d taken December’s euphoria too far.

To be sure, not much can be gleaned from a few days’ trading when it comes to how the year will unfold, history shows. Still, the swings were yet another reminder of the hazards of overconfidence when plotting the outlook for rate-sensitive strategies, especially after a year in which Wall Street efforts to predict market moves ended in misery.

“Investors were getting complacent and expecting a hat trick of fading inflation, stable job growth, and earnings up and to the right,” said Michael Bailey, director of research at FBB Capital Partners. “This week has muzzled some of the bulls.”

In a reversal from the everything rally in the final months of 2023, all major asset classes fell in the holiday-shortened week. Widely followed exchange-traded funds tracking equities and fixed income declined at least 1.5% over the first four sessions, the worst pan-markets slump to start a year since the two popular bond ETFs were created in mid-2002.

Current Headwinds

Though headwinds such as Apple Inc. downgrades and heavy corporate issuance weighed on markets, complacent investor positioning particularly around central-bank policy was the key accelerant. In fixed income, traders had viewed a Fed interest rate cut in March as a sure bet in late December.

Now, the implied probability has been pared to around 70% or so. For all of 2024, swaps point to a total of 137 basis points of rate cuts, versus about 160 basis points last Wednesday. Much the same pattern played out in Europe.

The repricing drove 10-year Treasury yields back to 4%, retracing more than half of the decline since Dec. 13 when Fed Chair Jerome Powell laid the groundwork for monetary easing later this year. It’s easy to point finger at the lopsided positioning.

A JPMorgan Chase & Co.’s survey showed its clients’ net long positions in the Treasuries market surged toward the highest since 2010 in November, before being gradually trimmed down since then.

“People wanted to jump on what is seen as a sea change, move from rates no longer going up,” said Alan Ruskin, chief international strategist at Deutsche Bank AG, on Bloomberg TV. “I think that made sense, but then the market just got ahead of itself. Now, we are in retreat.”

In the stock market, the pullback followed a flurry of buying that had sat uneasily with Wall Street contrarians. Aggregate inflows into U.S. equity ETFs reached 0.18% of total market capitalization on a four-week total basis, the highest level in seven years, data compiled by Ned Davis Research show.

S&P 500 vs ETF flows. Source: Ned Davis Research

S&P 500 vs ETF flows. Source: Ned Davis Research

Hedge funds, which resisted chasing gains in November, gave in last month, with their net flows turning “meaningfully positive,” according to prime-broker data compiled by JPMorgan. While the broad exposure has yet to reach extreme levels, the swift bullish pivot sparked caution among the team led by John Schlegel.

Of particular concern was the pace at which fund clients unwound their bearish wagers. The amount of short covering since late October was larger than any period since 2018, aside from the pandemic rebound in March 2020.

January 05, 2024 at 05:01 PM

January 05, 2024 at 05:01 PM

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.