JPMorgan Chase & Co. and Morgan Stanley expect U.S. investment-grade bond returns to beat speculative-grade debt in 2024, for the first time in four years, as investors position for interest-rate cuts and slower economic growth.

Bank of America Corp. recommends higher-rated bonds over junk debt as it sees rates, earnings and issuance challenging credit this year.

Fixed-rate debt — what investment-grade companies typically issue — is more sensitive to interest-rate hikes, and investors holding such bonds should benefit from the Federal Reserve lowering borrowing costs this year.

At the same time, a slowing economy could weigh on the performance of lower-rated debt, a scenario that Morgan Stanley expects this year.

“It comes down to the macro environment,” Morgan Stanley strategist Vishwas Patkar said in a phone interview Tuesday. “We think the economy will see a soft landing, but that happens with bumps along the way.”

He sees a better upside for returns coming from shorter-dated debt such as five-year bonds rather than longer-duration credit, which benefited from a rally in December and has limited upside now.

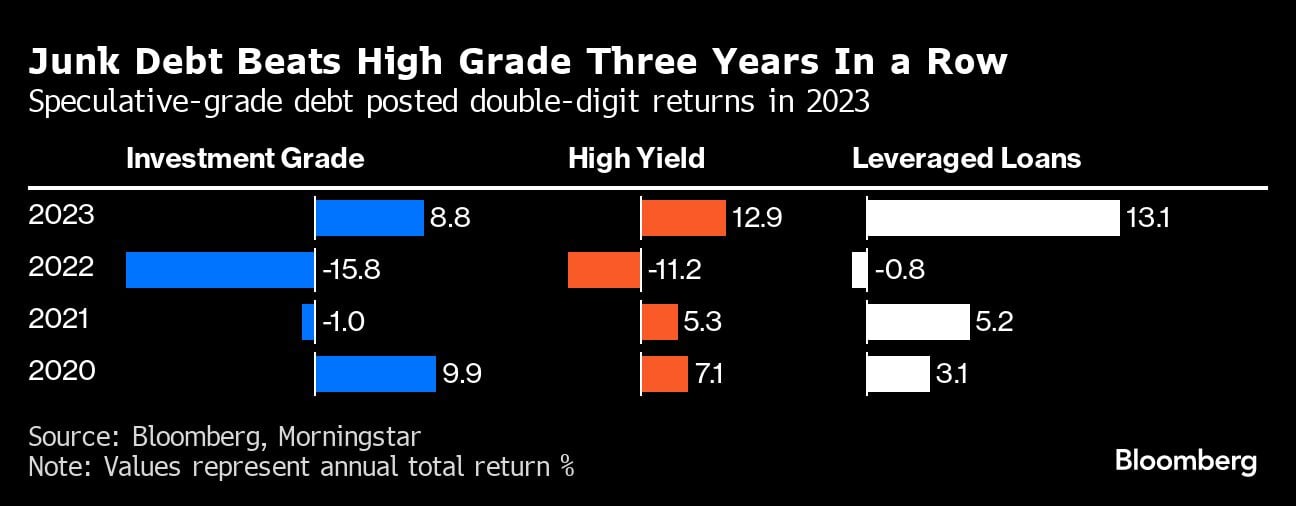

Globally, investment-grade debt struggled to advance in 2023 until a rally beginning in November catapulted returns nearly 10%, the biggest two-month jump on record.

Before that, the prospect of interest rates remaining higher for longer dampened performance, while stronger-than-expected economic growth pushed returns for both high-yield bonds and leveraged loans to 13%.

January 02, 2024 at 03:33 PM

January 02, 2024 at 03:33 PM

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.