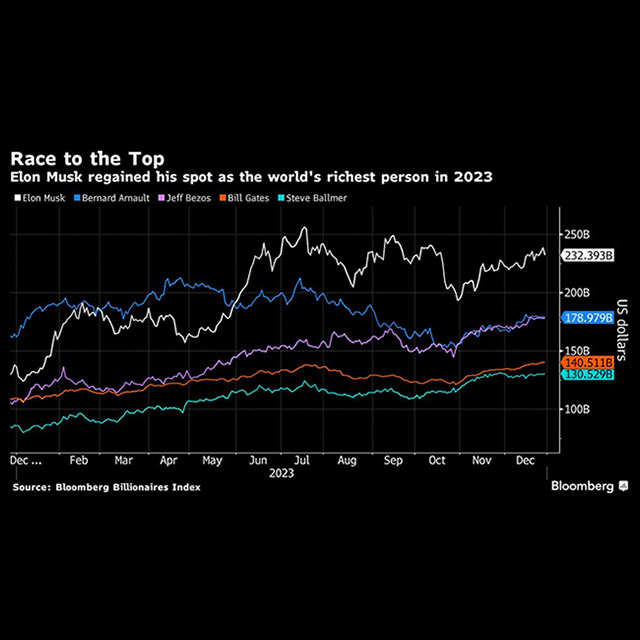

It was a comeback year for the world’s wealthiest.

The combined net worth of the 500 richest people surged by $1.5 trillion in 2023, fully rebounding from the $1.4 trillion lost the year prior, according to the Bloomberg Billionaires Index.

Once again, their fortunes were closely correlated to the performance of tech stocks, which rose to fresh records this year despite recession fears, lingering inflation, lofty interest rates and geopolitical turmoil. Tech billionaires saw their wealth grow by 48% or $658 billion, propelled by intense hype around artificial intelligence.

No one did better than Elon Musk, who recaptured the title of world’s richest person from French luxury tycoon Bernard Arnault.

The Tesla Inc. chief executive officer netted an additional $95.4 billion through Thursday’s close, bolstered by the success of Tesla and SpaceX, after losing $138 billion in 2022. His net worth is now more than $50 billion above Arnault’s after a global slowdown in demand for luxury goods dented shares of LVMH Moet Hennessy Louis Vuitton SE.

Amazon.com Inc. founder Jeff Bezos added more than $70 billion to his wallet this year and is now neck-and-neck with Arnault for second place, while Meta Platforms Inc. CEO Mark Zuckerberg’s fortune jumped by more than $80 billion.

The rising tide left some boats behind. Indian billionaire Gautam Adani lost $21 billion on Jan. 27 alone – and $37.3 billion across the whole year – after short-seller Hindenburg Research tanked the value of the Adani Group. Nevertheless, he still possesses an 11-figure fortune.

January 02, 2024 at 04:57 PM

January 02, 2024 at 04:57 PM

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.