Morgan Stanley and JPMorgan Chase & Co. are staking out bullish positions on equities as voters cast their ballots in midterm elections that are expected to end Democrats’ control of the legislative branch and usher in a period of gridlock.

Divided governments have a harder time agreeing to new legislation, and therefore tend to preserve the status quo, reducing uncertainty. That could bring about lower bond yields and higher equity prices, Morgan Stanley’s chief U.S. equity strategist Michael Wilson said in a note Monday.

And though their forecast isn’t tied directly to the election, JPMorgan strategists including Mislav Matejka also have a bullish outlook on stocks against the backdrop of a potential peaking in bond yields, “very downbeat” sentiment and positioning and good seasonal factors, they wrote in a note.

For specific areas like health, energy and tech, the makeup of the next Congress will be key to determining their path forward. If Republicans win control of both chambers, GOP lawmakers would have an easier time advancing their policy priorities that favor energy, defense, pharmaceutical and biotech companies, though President Joe Biden could use his veto power.

Play Video And for Morgan Stanley, a “clean sweep” by the Republicans could greatly increase the chance of fiscal spending being frozen and historically high budget deficits being reduced, fueling a rally in 10-year Treasuries that can lift equities.

Cannabis

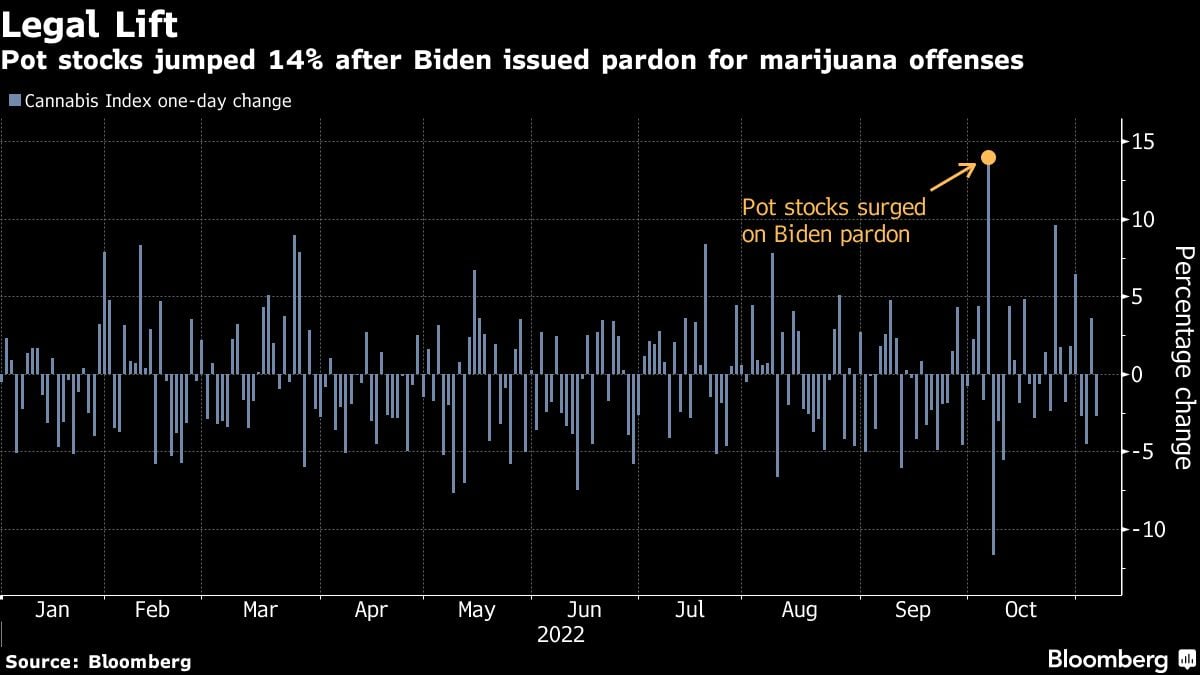

The cannabis sector has been hit hard this past year amid the fitful pace of US legalization and a broader risk-off mood among investors in the highly speculative industry. The Cannabis Index has plunged 57% in 2022, with Tilray Brands Inc., Canopy Growth Corp. and SNDL Inc. all sinking at least 46% each.

Investors will be closely watching several state referendums for progress toward legalization at a local level. Voters in Maryland, Arkansas, Missouri, North Dakota and South Dakota will weigh whether to approve legalization for adults.

“If four or five approve, it would probably be deemed a positive, but if Maryland does not approve, that would definitely be deemed a negative,” said Bloomberg Intelligence analyst Kenneth Shea.

Republican control of at least one chamber of Congress would likely push federal legalization off the table for now. Democratic control of both chambers, while unlikely, would be far more favorable for the cannabis industry. The Cannabis Index surged 18% last month when Biden issued a pardon for all prior federal offenses for simple possession of marijuana.

Health Care

Investors in the healthcare industry have been closely following developments from Washington around the issue of drug pricing, with the midterm elections magnifying ramifications for the sector.

Provisions that would empower Medicare to negotiate some drug prices under the Inflation Reduction Act are being marketed by Democrats as a landmark change that would lower drug costs for Americans. Not all high-price drugs will be subject to negotiations, but certain cancer treatments and other brand-name medicines used by seniors could have lower prices as early as 2026.

“Republicans have traditionally been more favorable to the drug industry than Democrats,” Cowen analyst Rick Weissenstein wrote in a note Oct. 14. “While Republicans won’t be able to repeal the drug pricing provisions, they have vowed to hold hearings on the plan and to look for other ways to slow down implementation of the bill.”

Pharmaceutical companies including Pfizer Inc., AbbVie Inc., Eli Lilly & Co. and Merck & Co. could all see their revenue outlooks impacted by any changes to rules on drug pricing.

U.S.-Listed Chinese Stocks

A threat to delist Chinese stocks that trade on U.S. exchanges but don’t comply with Trump-era audit laws has backing from both Democrats and Republicans. That support, as well as growing geopolitical tension surrounding China, has sent the Nasdaq Golden Dragon China Index plunging about 40% this year.

If Republicans take full control of Congress it will ratchet up the intensity of oversight and likely lead to hearings not only over the status of audits but also if Chinese firms should even be listed in the US at all, according to Jaret Seiberg, an analyst at Cowen & Co.

If Republicans take full control of Congress it will ratchet up the intensity of oversight and likely lead to hearings not only over the status of audits but also if Chinese firms should even be listed in the US at all, according to Jaret Seiberg, an analyst at Cowen & Co.

November 08, 2022 at 02:38 PM

November 08, 2022 at 02:38 PM

Even if Biden somehow gets the votes he needs to move forward with a windfall tax — which, to be clear, is a longshot at best — there is a potential upside for energy stocks, according to Louis Navellier, the chief investment officer at Navellier & Associates. The idea is that the levy would discourage new investment, thereby curbing oil supplies and driving prices even higher.

Even if Biden somehow gets the votes he needs to move forward with a windfall tax — which, to be clear, is a longshot at best — there is a potential upside for energy stocks, according to Louis Navellier, the chief investment officer at Navellier & Associates. The idea is that the levy would discourage new investment, thereby curbing oil supplies and driving prices even higher. Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.