What You Need to Know

- Most advisors are optimistic that the Secure 2.0 Act will help clients meet their retirement goals, according to a Prudential survey.

- A majority think the law will benefit their practices.

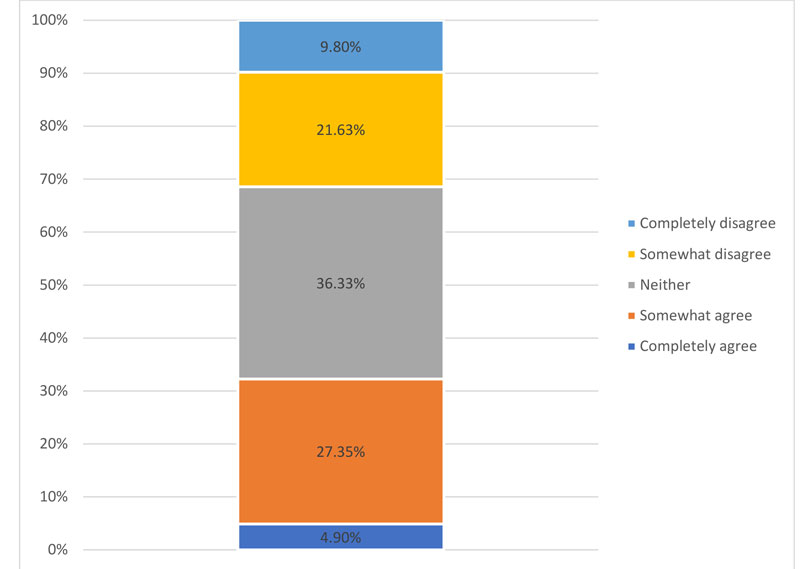

- Advisors are more divided on whether the law will drive a rush of 401(k) assets to annuities in the next 12 months.

The passage of the Setting Every Community Up for Retirement Enhancement (Secure) 2.0 Act in late 2022 represents a relative bright spot in our increasingly polarized political landscape.

As a follow-up to the Secure Act, signed into law at the end of 2019, the new law has a variety of provisions designed to improve retirement outcomes for Americans. While many of the provisions are specifically targeted toward defined contribution plans, there are a variety of implications for financial advisors, even those who don’t work directly with plan sponsors, given the potential implications on their clients.

In this article, I’ll review the results of a recent Prudential survey conducted online among 245 U.S.-based financial professionals on Jan. 30, 2023, focusing on three questions that provide some context about how financial advisors are feeling about the legislation.

To summarize: Financial advisors are cautiously optimistic about the long-term benefits, but are very divided on whether we’ll see a meaningful increase in the availability of annuities in defined contribution plans.

Positive Expectations for Retirement Outcomes

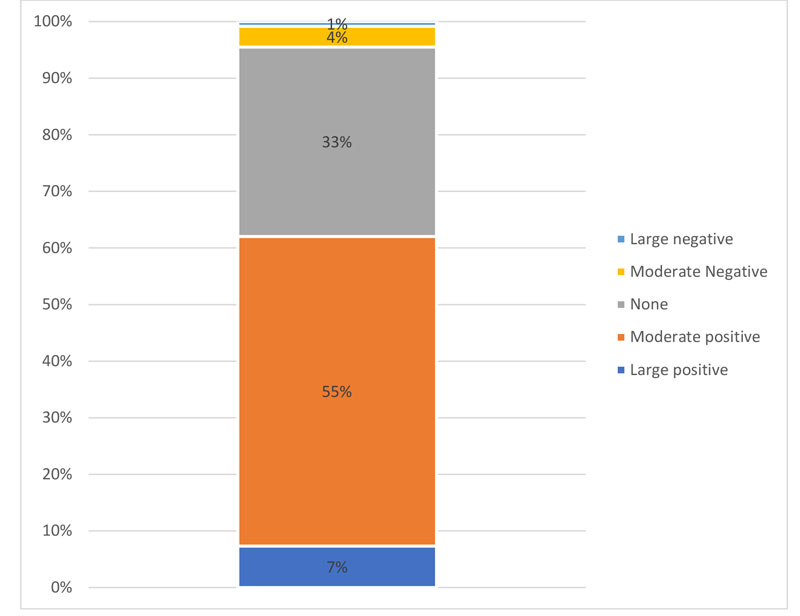

When asked how much they expected Secure 2.0 to benefit clients’ progress to their retirement goals, advisors were optimistic:

In other words, advisors expect the legislation to improve retirement outcomes. This isn’t necessarily a surprise given the increases in things like 401(k) catch-up contributions, delayed required minimum distributions, and increased coverage (i.e., enrollment) in company-sponsored defined contribution plans.

May 16, 2023 at 03:31 PM

May 16, 2023 at 03:31 PM

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.