Investors have just turned back the clock on the Fed’s tightening campaign and cast aside the Fed fears that ruled them for 15 months.

The S&P 500 index capped a fifth straight week of gains and is now higher than it was on March 16, 2022, the day the Federal Reserve embarked on the most aggressive rate hikes in four decades.

U.S. stocks are not alone — from the dollar to bond volatility to equity-market positioning, key metrics are back near levels seen before 500 basis points of rate increases.

Markets once bound to the Fed’s efforts to ease economic growth and inflation are now focusing on the health of corporate balance sheets and the potential for a surge in capital outlays as companies retool for an AI boom.

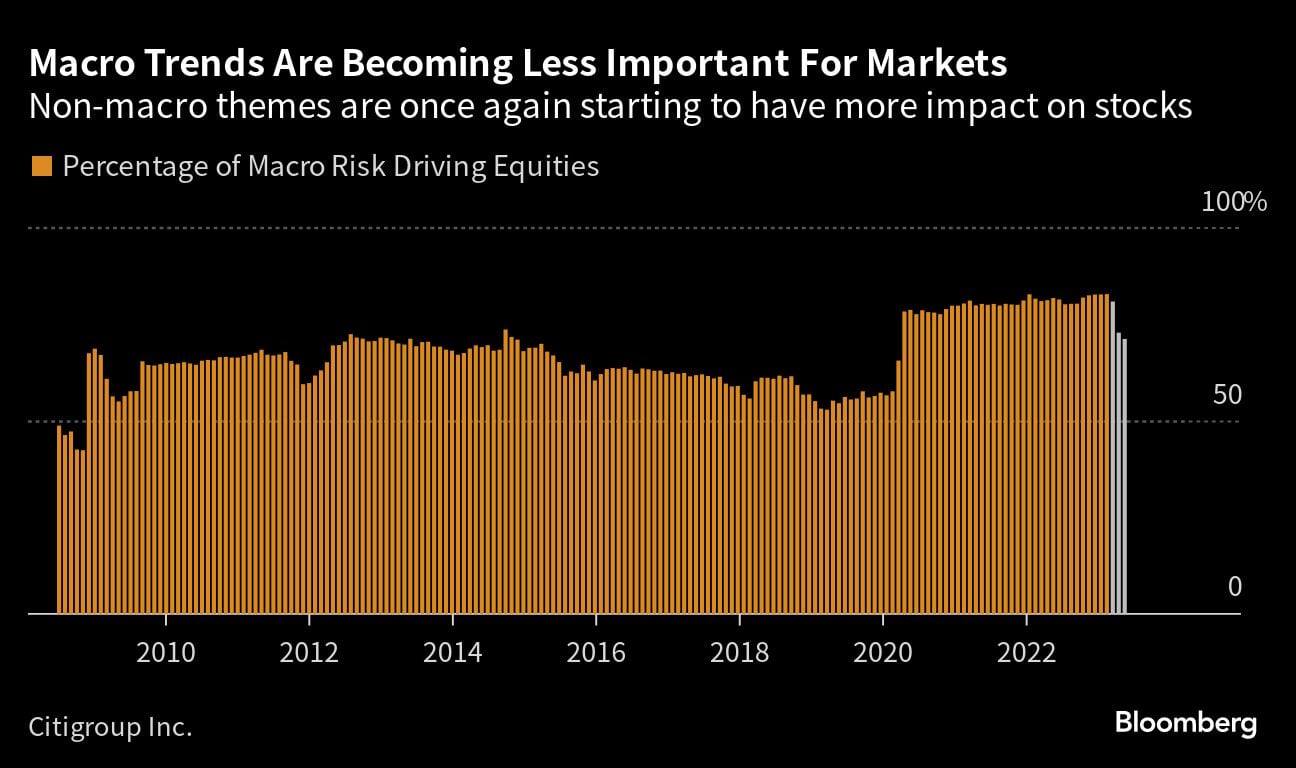

The macro contribution on equity markets has fallen to 71% from 83% since March — the biggest three-month drop since 2009, according to a Citigroup Inc. model.

“The Fed will probably be a little less important over the next six to 12 months than they have been,” said Jonathan Mackay, head of platform distribution at Schroders. “Other global drivers and fundamental drivers will take more of a bigger role as the Fed potentially starts their pause period.”

With the Fed signaling it’s near the end of its rate increases, Treasury investors expect volatility to subside after enduring some of the biggest daily yield swings in years. Geopolitics and China’s economic strength stand to regain prominence in investment theses.

With the Fed signaling it’s near the end of its rate increases, Treasury investors expect volatility to subside after enduring some of the biggest daily yield swings in years. Geopolitics and China’s economic strength stand to regain prominence in investment theses.

“Previously we’ve known that the Fed is just going to hike rates because it has too because inflation is too high,” said Fiona Cincotta, senior market analyst at City Index. “Now, it’s going to be much more data dependent.”

Markets have had a flying first half of 2023, coaxing investors off the sidelines and forcing strategy reversals by some of Wall Street’s loudest bears.

A measure for aggregate equity positioning by Deutsche Bank AG turned overweight for the first time in more than 16 months, sending it back to levels last seen before the start of the cycle.

Volatility has tumbled in bonds and equities: the ICE BofA MOVE index of expected price swings in U.S. government debt is trading near its pre-tightening nadir, while the Cboe Volatility index which measures stocks is hovering around levels last seen in 2020.

June 19, 2023 at 10:10 AM

June 19, 2023 at 10:10 AM

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.