Advisors are finding themselves fielding more questions than ever about digital assets. When Bitcoin burst onto the scene many years ago, it took a while for the industry to even grasp the definition of a “cryptocurrency,” let alone appreciate the underlying process of tokenization and what it could mean to the future of investing.

Years later, non-fungible tokens, or NFTs, have become one of the hottest topics on Wall and Main Streets alike, as investors realize the promise of assets — in this case, digital art — which has a value that can be broken up into digital tokens, stored and transacted on a digital ledger.

Given the intense interest around digital assets right now, financial advisors find themselves fielding a lot of questions about NFTs. Here we attempt to shed some light on this emerging asset class for advisors seeking to inform their clients:

What is an NFT?

To understand NFTs, it helps to understand the history of where they came from. Let’s start with Generative Art — an original piece of artistic work created by a computer, as opposed to a human. In essence, the computer becomes the artist.

These pieces are usually created by an algorithm based on a set of rules and parameters input by a human programmer, but the computer ultimately produces the original pieces of art. (This type of art form is not new but has been around since the 60s.)

These unusual pieces of pixelated art may look funny to skeptics, but like any rare collectible their value lies in their originality. While there may be infinite copies, ownership rights to the original, “true” version can fetch a significant price. In the case of Generative art like the CryptoPunks, Visa recently paid $150,000 an NFT from the series.

How They Work

The process behind NFTs works something like a digital version of securitization. Proof of ownership is converted into a token or tokens that signifies a claim to its authenticity.

This token is “non-fungible,” meaning that there is one true version that cannot be replaced by a copy — hence the term “Non-Fungible Token. These tokens are delineated in the Ethereum cryptocurrency and stored on a digital ledger, or blockchain.

When you combine these two elements — tokenization with a piece of generative art — you have a very powerful new type of collectible. That NFT is not just a collectible, but a multi-faceted piece of technology.

A Growing Marketplace

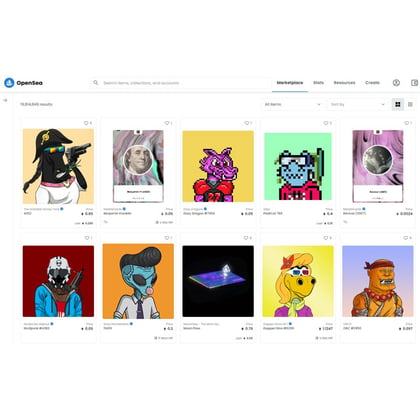

Ethereum is the protocol that drives most of the NFT business today. For example, OpenSea, the largest NFT marketplace in the world, is built on Ethereum. OpenSea reached $322 million in transaction volume on Aug. 29, 2021, breaking its own record of $235 million just one day prior.

To put this in perspective, OpenSea only processed $21 million in transaction volume throughout the entirety of 2020. CryptoPunks, which are also built on Ethereum, recently reached an all-time high trading volume of over $950 million. I purchased my first CryptoPunk in 2017.

So how can your clients earn a return with these assets? Let’s look at decentralized finance, or “DeFi” as a primary use case. Decentralized finance enables one to stake their cryptocurrency in a liquidity pool and earn a return lending those assets.

Those returns typically outperform traditional returns. The total value locked in DeFi protocols currently sits at just over $90 billion. If we connect that to an NFT, then you have a collectible creating a return for your client, simply by staking it.

Another other investor-friendly feature of NFTs is the ability to leverage them for immediate liquidity. You can’t do that with art that hangs on your wall.

This generation of innovators is basically creating economies around collectibles. The collectible market currently makes up around 70% of the total NFT market.

February 08, 2022 at 01:25 PM

February 08, 2022 at 01:25 PM

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.