What You Need to Know

- The overwhelming majority of the value fund inflows went to passive funds.

- Commodities were the only U.S. fund category to experience outflows.

- Fund families known for passive management, like Vanguard, were the winners in March.

March 2021 was an exceptional month for mutual fund and ETF inflows.

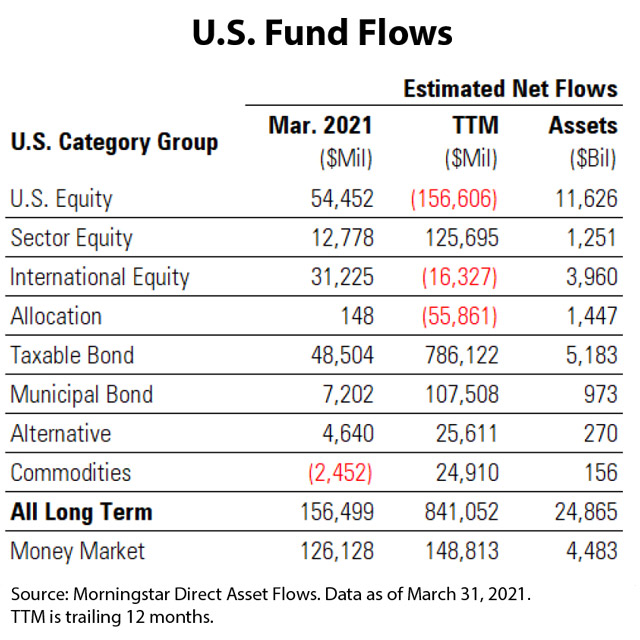

The funds collected a record $156 billion in net flows for March, breaking the $144 billion record set just the month before, according to Morningstar’s latest monthly fund flows report.

Monthly records were set for U.S. equity funds inflows — $54 billion — and emerging market equity fund inflows — $14 billion. Value funds continued their comeback, with large-cap U.S. value funds collecting $20.1 billion in March and small-cap value funds collecting $5.4 billion— both in line with the resurgence in the performance of value stocks.

Investors also favored international equity funds, taking in $31 billion, their highest inflows since January 2018. Diversified emerging market funds collected a record $14 billion.

Positive flows into fixed income funds continued for the 12th consecutive month, at $48 billion in March, capping a whopping $786 billion over the past year.

Commodities were the only U.S. fund category to experience outflows. A total $2.5 billion flowed out of commodity funds — more than twice the level that left in February.

April 22, 2021 at 03:36 PM

April 22, 2021 at 03:36 PM

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.