BlackRock Inc. will dismiss about 600 employees, or roughly 3% of its global workforce, as it seeks to reallocate resources amid rapid changes in asset management.

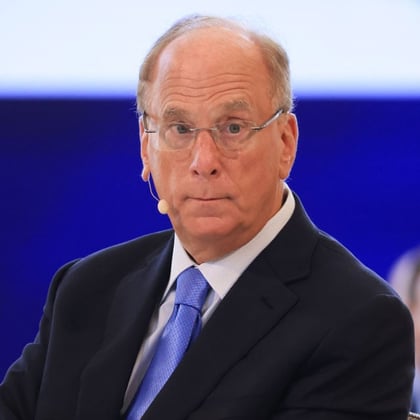

“We see our industry changing faster than at any time since the founding of BlackRock” in 1988, Chief Executive Officer Larry Fink and President Rob Kapito wrote Tuesday in a memo to staff.

The executives said that ETFs have become the preferred vehicle for both index- and active-investment strategies, and that the firm is growing across the globe — including in Europe and Asia.

“And, perhaps most profound, new technologies are poised to transform our industry — and every other industry,” Fink and Kapito said in the memo.

The world’s largest asset manager said it still expects to have a larger staff by the end of the year, even with the cuts, as it expands certain parts of the business.

The asset-management industry has been buffeted over the past two years, first by declines in stock and bond markets in 2022 and then by investors who grew skittish over higher interest rates.

BlackRock is among big money managers, including Wellington Management and T. Rowe Price Group Inc., that have recently cut jobs and redirected budgets in response.

BlackRock increasingly seeks to position itself as a one-stop shop for investors offering equity, bond and money-market funds and strategies for private assets, as well providing tech, data, analytics and financial markets advice to clients.

The company also aims to expand into the growing market for alternative investments, with the goal of doubling revenue from private markets over the next five years.

January 09, 2024 at 04:15 PM

January 09, 2024 at 04:15 PM

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.