The monster run in equities and other risk assets that shaped the final stretch of 2023 has room to run well into the new year if inflation continues to ebb, according to strategists at BlackRock Inc.’s Investment Institute.

Momentum from the Federal Reserve’s dovish shift last month may power the stock market “well into 2024” if price pressures continue to ease, according to a team led by Jean Boivin, BII’s head of research, and global chief investment strategist Wei Li.

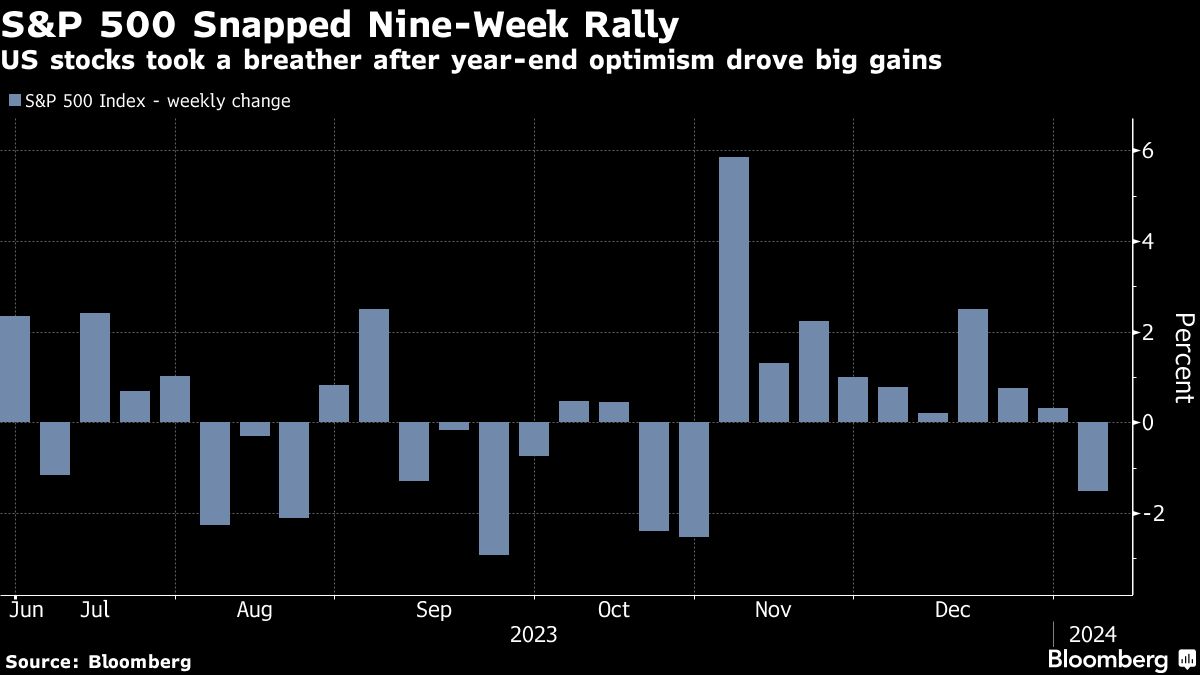

The S&P 500 Index capped 2023 within spitting distance of its all-time high, climbing 24% for the year as the US economy remained resilient in the face of the highest interest rates in more than two decades.

That optimism bolstered by expectations for cuts in 2024 and enthusiasm around artificial intelligence propelled technology shares toward their best year since the dot-com boom.

Gains in U.S. stocks accelerated in the final weeks of trading after Fed officials affirmed their readiness to ease monetary policy this year.

“That once again highlighted how hopes and disappointments about the Fed drove market flip-flops throughout 2023,” the strategists wrote in weekly commentary Monday. “The final rally was no different, in our view. It has left equity markets priced for a near-perfect outcome: a soft landing, where inflation falls and central banks sharply cut rates.”

U.S. stocks, however, have had a rocky start to 2024 trading, snapping a nine-week winning streak on Friday. The year’s jittery kick off for stocks and bonds indicated that investors may be nervous about the macroeconomic outlook, according to the team led by Boivin and Li.

BlackRock Investment Institute expects the consumer price index readout this Thursday to show falling goods prices leading inflation lower in 2024, but they anticipate supply constraints putting inflation on a “roller coaster.”

January 08, 2024 at 02:56 PM

January 08, 2024 at 02:56 PM

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.