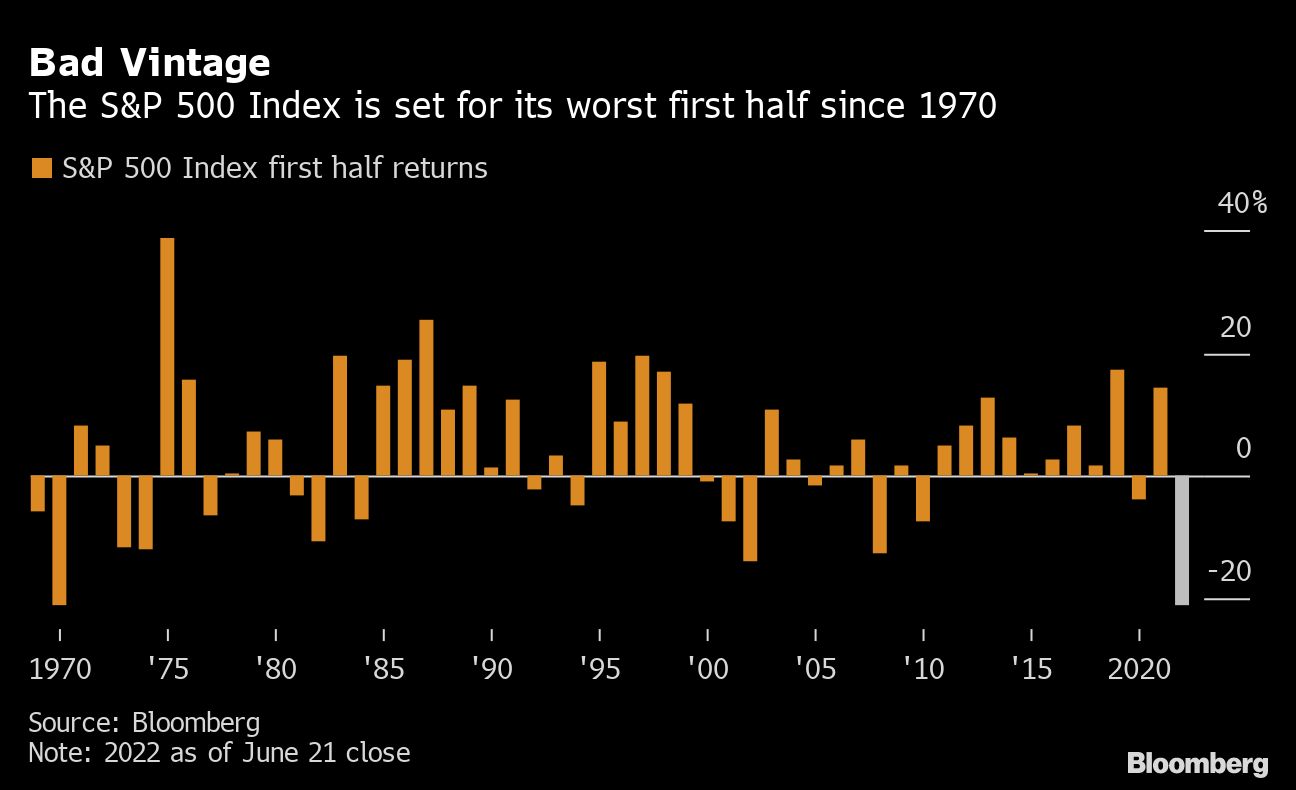

The S&P 500 is now poised for its worst first half since Richard Nixon’s presidency.

With just seven trading days left until the end of June, the index is down 21% since the beginning of the year amid expectations that a toxic mix of high inflation and a hawkish Federal Reserve will tip the US economy into a recession.

The last time the S&P 500 had fallen this much during the first six months of any year was in 1970, according to data compiled by Bloomberg.

A 1970’s-style inflation shock could send the index crashing about 33% from current levels to 2,525 amid stagnation with higher inflation, according to Societe Generale SA strategist Manish Kabra.

The key read-across from the 1970s is the risk that if investors start to believe that inflation will stay high for longer, equity markets begin to focus on real instead of nominal earnings-per-share rate, which for this year is likely to be negative, SocGen said.

June 22, 2022 at 10:12 AM

June 22, 2022 at 10:12 AM

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.