A growing number of full-service and self-directed wealth management clients are logging into wealth websites and apps, J.D. Power reported last week. And the more often they do that, the more satisfied they are.

“The wealth management industry has transformed during the past few years with the rise of no-fee trading and advances in technology, democratizing access to tools and sophisticated investment advice,” Craig Martin, global head of wealth and lending intelligence at J.D. Power, said in a statement.

“The digital experience is a crucial component of an effective client acquisition and retention strategy. The self-directed account has increasingly become the gateway through which firms build the foundation of more lucrative investor relationships. Firms that get the digital formula right are positioning themselves for long-term success.”

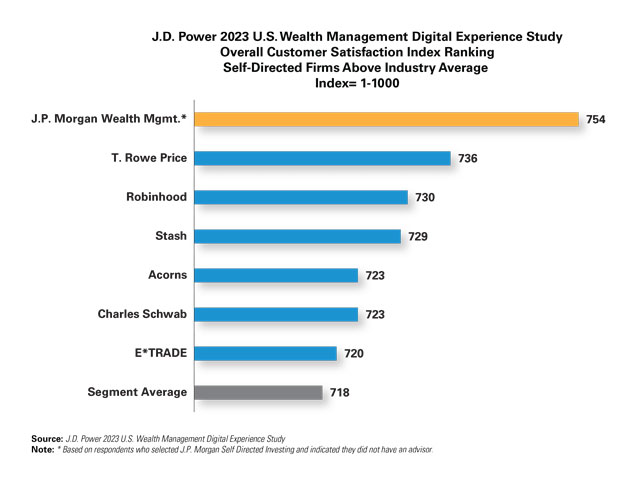

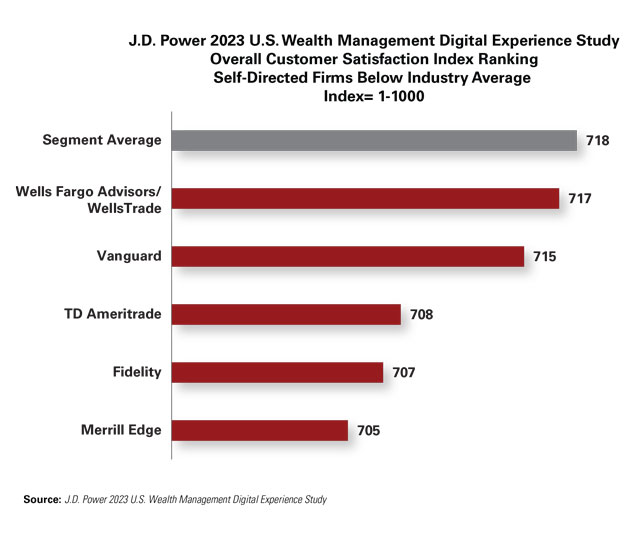

J.D. Power’s research showed that the overall average satisfaction score for U.S. full-service wealth management mobile apps is 776 (on a 1,000-point scale), which is 11 points higher than the average score for full-service wealth management websites. Among self-directed wealth management apps, overall satisfaction is 738, while website satisfaction is 704.

Millennial and Generation Z clients show a significant preference for digital:

- As their primary communication channel for advice, 56%

- For planning, 59%

- For service, 74%

Gen X and baby boomer clients still prefer human interaction for advice and planning, the study said.

J.D. Power researchers found that among both full-service and self-directed investors, overall satisfaction increases significantly the more often that clients interact with wealth management websites and apps.

The overall satisfaction score among full-service investors who use their wealth management firm’s app on a daily basis is 798, which is 97 points higher than among those who never use the app and 53 points higher than among those who use the app only once a year.

Among both full-service and self-service wealth management providers, large banks perform particularly well, according to the study. J.D. Power said their superior performance is likely the result of robust digital capabilities they have developed in their respective retail banking operations.

The J.D. Power study evaluates customer satisfaction with the wealth management digital experience, inclusive of both apps and websites, based on four factors: visual appeal, navigation, speed and information/content. This year’s study, which was fielded from June through August, is based on responses from 6,217 full-service and self-directed investors.

See the charts below for the best and worst full-service wealth management digital experience according to customers.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.